Tesla Stock - ARK's $4,600 Price Target for 2026

Before we dive into the reasoning for the latest price target, let us remember the older versions of ARK's predictive models that used to cause scepticism among investors.

Watch this video from early 2018 where ARK's CEO Cathy Wood predicted a $4,000 price target ($800 post 5:1 split). Remember, this was before the massive stock price and pre-split run-up.

Today in Mid of April 2022, the Tesla stock price is at approx. $5,000 (pre-split price) or $1,000 post-split. A valuation many people found hard to believe in early 2018.

On April 14th, ARK's published their updated model, stating a $4,600 price target for 2026, which will be more than 4x today's price. Here is the published article - which I highly recommend reading.

The following briefly summarises ARK's research and some additional aspects to consider for modelling the size of Tesla's future business. And no, this is not financial advice - this is an attempt to draw a more comprehensive picture of possible scenarios in the future - especially after 2026. All pure speculation - end of disclaimer!

When reading ARK's research, it's essential to understand that they ran a statistical model that created many different scenarios. Input for those scenarios are assumptions about crucial business metrics like the numbers of cars sold, the average selling price of those cars etc. And the outcome is the probabilities of different scenarios based on the underlying assumptions. So the result is a price target range from $2,900 up to $5,800 for 2026. There is the assumption of "only" selling 10 Million cars in the lower end case, while the $5,800 scenario is based on 17 Million sold cars. Again, read the linked article for all the details.

The key takeaway is - that this model is almost solely based on Tesla's vehicle business and the RoboTaxi opportunity. What is not included in the model is the following:

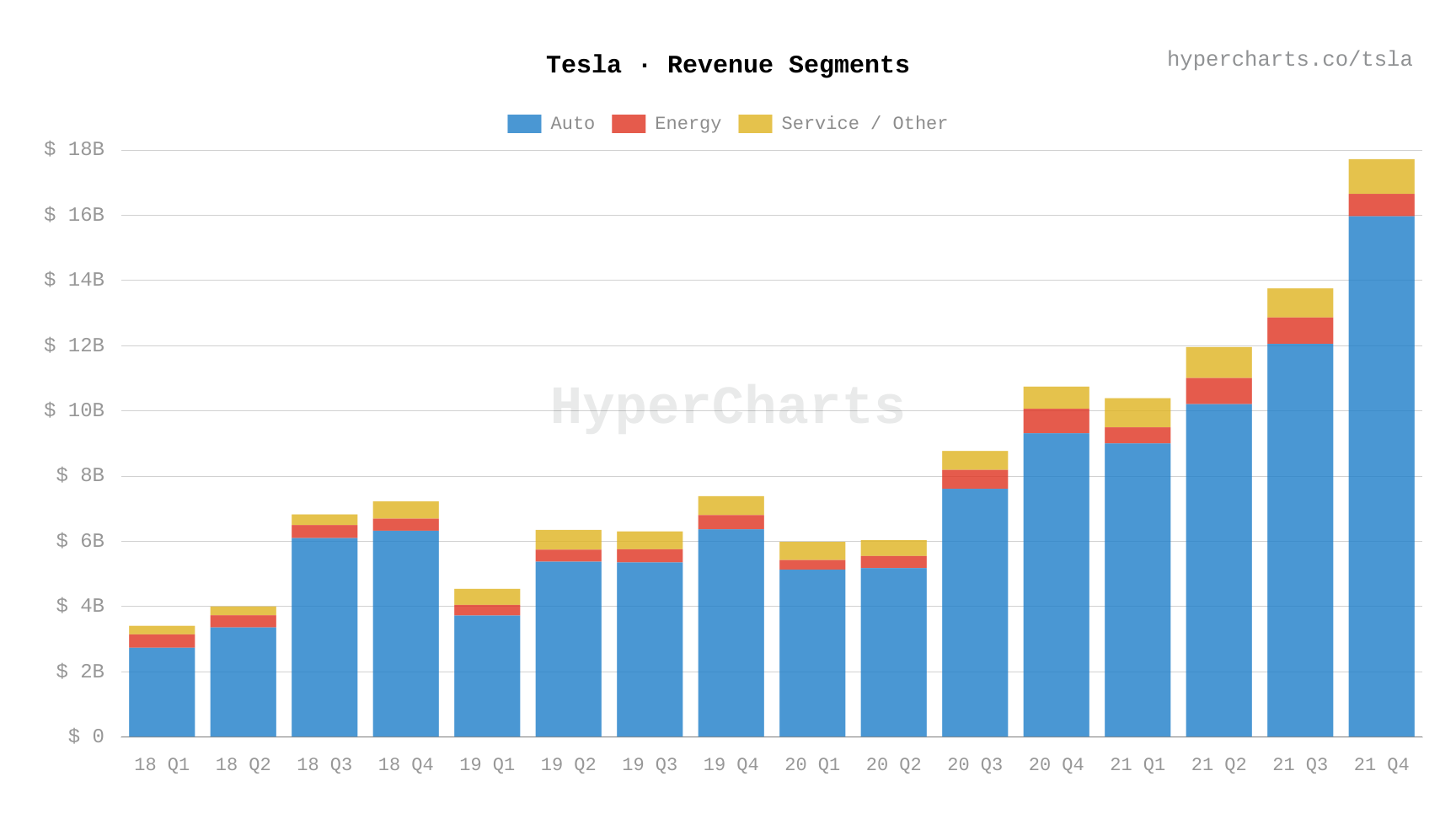

- Teslas energy business

- AI-as-a-service

- Humanoid robot

And for 2026, it seems reasonable from ARK's perspective not to include those aspects of the business because all of these aspects contain a level of uncertainty which would lead to high volatility in the model. For example, Telsa prioritised its vehicle business in the past years, which might also be the case for the following years. This is mainly due to the limitations in the availability and scalability of the batteries. And the solar business relies on third parties for installations, which makes scaling even more complex.

Elon Musk already mentioned that Tesla is open to licensing its software, including its A.I. training systems, as a service, but there haven't been any announcements of potential partnerships yet.

For the humanoid robot, the timeline is also challenging to predict. In the past, Tesla struggled with developing its vision-based A.I. for Full-Self-Driving. While iterating different models, those models so far always seemed to hit the ceiling at some point. The humanoid robot's heavy lift will be the vision-based A.I. that Tesla is currently developing for its cars. So, no A.I. vision, no robot.

But if you thought that the size of the business, modelled by ARK invest, for 2026 is gigantic, you should zoom out and consider the following.

- Elon Musk many times stated that the energy business is going to be bigger than the vehicle business (probably ex. FSD). And in the most recent interview with TEDs, Chris Anderson Elon estimated a total size of the energy requirements of about 300 TWh, of which Tesla wants to contribute around 10%.

- The FSD real-world A.I. component is probably the most valuable SaaS product in the foreseeable future. And as with all SaaS products, it will be high margin and easy to scale globally.

- Teslas Robot will redefine the labour market by allowing to significantly increase the productivity while closing the labour shortage.

Dave Lee illustrated the S-curves of Teslas' technologies in the following two:

The four technology adoption S-curves for Tesla:

— Dave Lee (@heydave7) February 12, 2022

1st - EVs

2nd - FSD/Robotaxi

3rd - Energy

4th - AI Robots

Each successive S-curve happens to be much larger than the previous. And we're just getting started with the first. pic.twitter.com/wdSrIlaZvB

Although he later mentioned that those curves are not "drawn to scale", the total addressable market for the energy and labour markets is significantly bigger than the market for vehicles and ride-hailing. Although ARK's prediction might seem very ambitious for many observers the even longer-term perspective on the business opportunity dwarfs the E.V. and FSD business.